No products in the cart.

Míexɔ wò nyuie ɖe volta nutoa me, teƒe si nànya nu geɖe tso alẽtsuwo ƒe amewo kple nyadzɔdzɔwo ŋu le

- My Account

- Members

- News

- sports

- Sport-videos

- Volta FA Profile

- Volta Football Teams Profile

- Submit Volta Football Team profile

- Volta basketball Association Profile

- Volta Basketball Teams Profile

- Submit Volta Basketball Team Profile

- Beach Soccer Teams profile

- Submit Beach Soccer Team Profile -VR

- All Leagues matches

- Ghana Premier League

- Ghana Division One League

- Business

- Entertainment

- Foreign

- Country

- History

- Voltaweb Shop

- LIVE RADIO

Rising Stars 2021

VoltawebMarch 10, 20226 Mins read49 Views

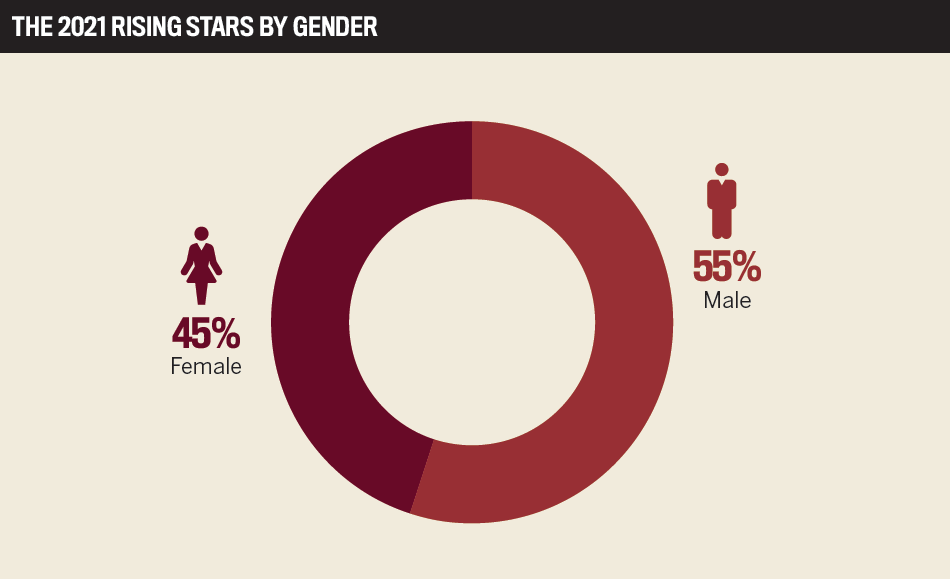

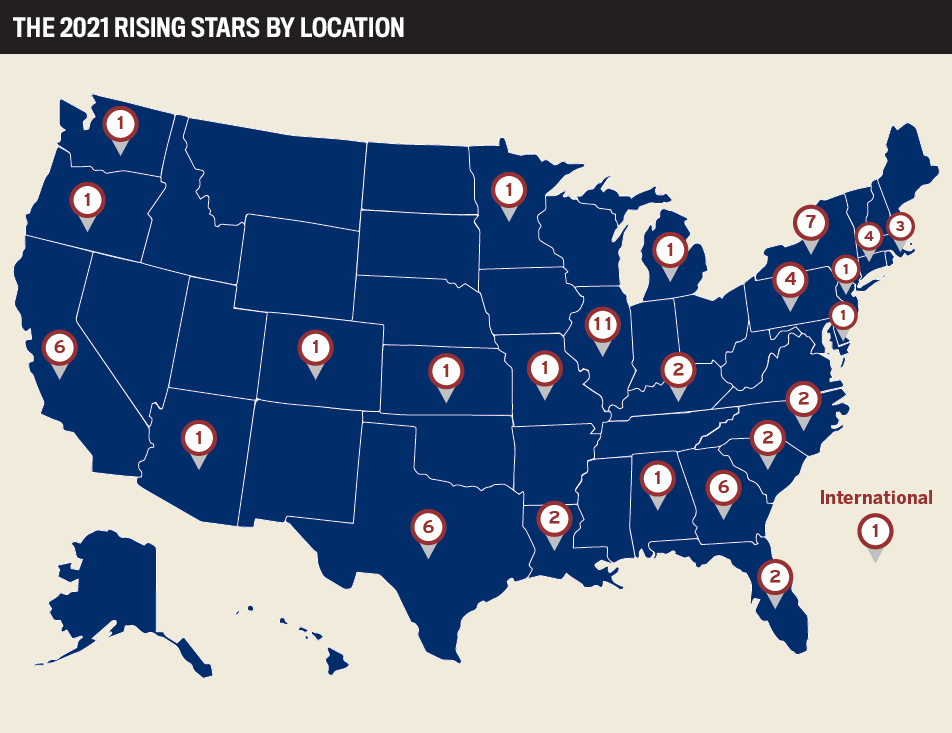

VoltawebMarch 10, 20226 Mins read49 ViewsWho says insurance isn’t a young person’s career? While it’s true that many millennials and Gen Zers tend to discount the idea of working in insurance, the industry offers many things that idealistic young professionals seek. It’s a service-oriented career that offers endless opportunities for specialization, while also providing plenty of job security and a healthy works and AARP, which will open up many opportunities for advancement in the near future. Among those taking up the reins of power are likely to be the 69 members of this year’s Rising Stars list – industrious individuals who have gone the extra mile to distinguish themselves among their contemporaries.

Finding insurance

“Most of my peers, we share the same view and passion for wanting to bring creativity to insurance,” says Mike Mueller, a Denver-based area senior vice president at Risk Placement Services (RPS).

Mueller grew up in an insurance family and started helping out around the office at age 13; by 15, he was checking policies and binding, and at 18, he had his customer service representative (CSR) license. He went on to major in risk management and insurance at Florida State University.

“I moved to San Francisco after college,” Mueller says. “I was completely by myself. I had $500 to my name and two suitcases and said, ‘If this doesn’t work, I’ll go back home.’” Things did work out, and Mueller eventually ended up at RPS, where he’ll celebrate his 10-year anniversary in 2022.

Specializing in property and builder’s risk coverage, Mueller has acquired a passion for construction. “I always thought it was cool,” he says. “We’re looking at artists’ renderings, budgets and timelines. Then the next thing you know, the project is under construction. And two years later, there’s this gorgeous building you can drive by and say, ‘I was involved in the insurance.’”

Like Mueller, fellow Rising Star Nathan Shoemake grew up around insurance and studied economics in college. But he didn’t think about pursuing a career in analytics until he was being considered for a role at AssuredPartners. He’s now the Director of IMPACT® Analytics at AssuredPartners’ national real estate practice.

“We provide risk analytics that often reveal new program strategies, as well as the evidence-based data needed to negotiate property values and provide the pricing, terms or deductibles we are seeking,” Shoemake says. “With my team crunching the numbers, we free up service teams to provide timely and impactful results.”

Another 2021 Rising Star who likes to find creative solutions to complex problems is Marianne Jozsi, vice president of risk management at Worthy Insurance. She began her career in the theme park industry, working for Six Flags Great America. After 10 years, she had worked her way up to a supervisor role but decided it was no longer a good fit for her. Seeing an ad for a job at Worthy, Jozsi realized that insurance was something she could do.

“I was interested in risk management because so much of the loss control portion of risk management ties into building positive safety cultures within institutions,” she says. “Culture building has always been something that interests and impassions me, so it was natural for me to move into the risk management role.”

Thriving in tough times

The COVID-19 pandemic gave Jozsi an opportunity to shine. She has spent the past year and a half creating tool kits, presentations and training guides for her clients, helping them significantly reduce workplace injuries and reported claims. During the same time, she also tripled the size of her department.

“We insure a lot of long-term care facilities,” she says. “We not only had to keep up with the influx of claims in the summer of last year, but we were in a position where we’ve been working to make sure we’re as updated on changing guidelines as possible.”

This includes constantly staying ahead of laws and CDC guidelines, as well as leveraging an unexpected skill: public relations. At the start of the pandemic, Jozsi realized the media would eventually be reporting sensationalized stories on some of her clients’ facilities, so she pre-emptively engaged PR agencies to help tell positive stories about their organizations.

Mueller also distinguished himself during the pandemic by growing his book of business by almost 300% to more than $40 million in premium. He did so in part by making the most of online videoconferencing and mailing his clients care packages.

“Another thing that really happened for my book was the market hardened for the direct marketplace, and we found more and more insurance coming into the excess & surplus industry,” Mueller says. “And they weren’t able to get coverage from people like Travelers, Liberty Mutual or Hartford. So, our expertise in the E&S space really paid dividends because a lot of these accounts weren’t getting renewal, and we were able to provide a solution and bring them into the marketplace.”

Secrets to success

Jozsi attributes her ongoing success to the fact that she’s “always been a driven person. I like to work hard and see resulting successes. I realized very early on that mistakes and setbacks are learning experiences. Challenges often just make me want to work harder because in my head I’m imagining someone telling me I can’t accomplish something. Telling me I can’t accomplish something is a surefire way to make me try my hardest to accomplish my goal.”

For Shoemake, success hinges on two things: taking responsibility and living up to his team motto to “always be helpful.” Within his analytics team, he says, it’s less about metrics and more about asking the important questions: Were his analytics good enough to get AssuredPartners hired? Were they able to help the underwriter provide competitive terms? Could they help resolve a client’s issues? Could they help lower estimated property values?

“The more we can answer yes to these types of questions, the more effective we are,” he says. “Although we can, we don’t just create pretty charts and graphs for our clients. All our work has a purpose.”

And when it comes to the future of analytics in insurance, Shoemake takes a holistic outlook.

“[Technology] has changed client expectations and has allowed us to do more to meet and exceed those expectations, not the least of which by providing some amazing data,” he says. “However, people are still important. We often say what we do is part art and part science. One must understand what to do with the data and how to present the data in a compelling way so that it helps the client make adjustments to improve their business risk profile or influences an underwriter to provide what we are seeking. I helped build our resources from ground up, so I understand in order to have best-in-class actuarial capabilities, we need to stay apprised of the latest technology available.”

Rising Stars

Ben Hickey

Jake Filak

Kyle Crosley

Mike Mueller

Pamela Flowers

Phil Richardson

Prabal Lakhanpal

Taylour Donovan

Waika Embry

Aaron Pfister, Burns & Wilcox

Abigail Caldwell, Amwins Group

Albert Reed, Burns & Wilcox

Alexandra Jennings, EPIC Insurance Brokers

Amanda Carver, Gallagher Bassett

Andy Flowers, Starke Agency

Annika Roney, Rokstone Construction Risk Underwriters

Ashlae Cook, Ollis/Akers/Arney Insurance & Business Advisors

Barrett Charpia, Insurance Office of America

Bob Slauson, True Benefit, an Amwins Company

Briana Wolff , The Hartford

Brittney Stinnett, Peel & Holland

Cameron Lock, ABD Insurance and Financial Services

Christopher Goodman, Goodman Insurance

Courtney Cassidy, CAC Specialty

Dan DiLella, Hotaling Insurance Services

Dave Rock, Nicolaides Fink Thorpe Michaelides Sullivan

Davis Howley, NSM Insurance Group

Ebens Jean, One Way Insurance Group

Emily Steinberg, Nicolaides Fink Thorpe Michaelides Sullivan

Erin Dullard, Swiss Re

Fabiola San Miguel, JAG Insurance Group

Gina Dean, Munich Reinsurance America

Ian Keith, Keith Insurance

Ilir Dinovic, SCOR

Jacob Kiley, The Liberty Company Insurance Brokers

Jason Levine, Irwin Siegel Agency

Jessica Scelzi, The Zebra

Jillian Raines, Cohen Ziffer Frenchman & McKenna

Jim Kilgallen, NSM Insurance Group

Ketan Nayak, Coalition

Kip Olvaney, Beecher Carlson

Krista Scott, The Hartford

Kyle McClellan, NSM Insurance Brokers, a division of NSM Insurance Group

Larry Phillips, Gallagher

Laura Malloy, RLI

Lauren Glass, Burns & Wilcox

Mandeep Brar, Marsh

Marianne Jozsi, Worthy Insurance

Meghan Brady, HUB International Northeast

Mira Andreeva, The Hartford

Morgan Cook, Beecher Carlson

Morgan Ramey McHugh, AssuredPartners

Nate Mathis, Amwins Group

Nathan Shoemake, AssuredPartners

Navarone Dozier, Palmer & Cay

Patrick Cagney, RT Specialty

Phillip Rehg, HUB International Northeast

Ranjini Vaidyanathan, CCC Intelligent Solutions

Rebecca Ferguson, Beecher Carlson

Sam Liggett, AssuredPartners

Sam Odishoo, USI Insurance Services

Samuel Tashima, Aon

Sean Gremillion, Resilience Cyber Insurance Solutions

Shay Eskridge, Liberty Mutual Insurance

Steven Giustino, Program Brokerage Corporation

Veronica O’Connor, AssuredPartners

Victoria Landry, InsureWise

Will Wilson Jr., McNeal, Sports & Wilson Risk Advisers

Zach Bowling, Amwins Brokerage of the Midwest

Methodology

Starting in June, IBA invited insurance professionals across the country to nominate their most exceptional young talent for the annual Rising Stars list.

Nominees had to be age 35 or under (as of June 1, 2021) and be committed to a career in insurance with a clear passion for the industry. In order to maintain a focus on new talent, only nominees who hadn’t been previously recognized as an IBA Rising Star (or Young Gun) were considered.

Nominees were asked about their current role, key achievements, career goals and the contributions they’ve made to shaping the industry. Recommendations from managers and senior industry professionals were also taken into account. The final list of 69 Rising Stars was determined by an independent panel of industry leaders:

• Deborah S. Morris, Verisk

• Owie Lei Agbontaen, Sompo Global Risk Solutions

• Rodney Johnson, Gallagher

• Tiara Morris, State Auto

• Veronica Kuyoth, Nationwide E&S/Specialty

Related Articles:

- Top Specialist Brokers

- America’s Best Professional Liability Insurance

- Insurance Business Global 100 2022

- Hall of Fame 2021

- 5-Star Wholesale Brokers and MGAs 2022

- 5-Star Professional Liability and D&O 2021

- Wawanesa upgrades broker platform to become “easiest insurer to do business with”

- Is flood insurance worth having in Australia?

- Kennedys lifts the lid on reputational risk initiative

- Hot List 2022

| NEWS SECTION |

|---|

| Educational News |

| Politics News |

| Health News |

| Country News |

| Volta Region News |

| FaFaa News |

| Press Release |

| Murder & Punishment |

| Africa News |

| Citizen Abroad |

| World BBC news |

| Ewe - Pride |

| SECURITY NEWS |

| READ MORE |

| OPINIONS |

| General Opinions |

| VOLTA TELEVISION |

| EwE 24 Tv news |

| Tosh TV |

| Volta General News Bloggers |

| Not Yet listed |

| Other News Section |

| General News |

| Sports |

| Entertainment |

| Business |

| Africa |

| Radio Stations |

Related Articles

General NewsGn-country news VoltawebMay 21, 2025

VoltawebMay 21, 2025

Why Is the Most American Fruit So Hard to Buy?

Pellentesque iaculis gravida nulla ac hendrerit. Vestibulum faucibus neque at lacus tristique...

VoltawebMay 21, 2025

VoltawebMay 21, 2025

General News VoltawebJuly 23, 2022

VoltawebJuly 23, 2022

The Best Place to Celebrate Birthday and Music

Mauris mattis auctor cursus. Phasellus tellus tellus, imperdiet ut imperdiet eu, iaculis...

VoltawebJuly 23, 2022

VoltawebJuly 23, 2022

General News VoltawebApril 17, 2022

VoltawebApril 17, 2022

Insurance ombudsman on “never-ending battle”

Being in the middle isn’t always easy – just ask Insurance &...

VoltawebApril 17, 2022

VoltawebApril 17, 2022

General News VoltawebApril 17, 2022

VoltawebApril 17, 2022

IMF announces support for NZ Income Insurance Scheme

The International Monetary Fund (IMF) has announced its support for the NZ Income...

VoltawebApril 17, 2022

VoltawebApril 17, 2022Services & Gov

- Volta Regional Coordinating Council

- VOLTA DISTRICT ASSEMBLIES

- Ghana Army (VR)

- Ghana Navy VR

- Ghana Immigration Service (VR)

- Ghana Police Service (VR)

- Ghana Prison Service VR

- Ghana Custom Service (VR)

- Ghana Fire Services (VR)

- ECG Volta Region

- Ghana Educations Services (V/R)

- Volta River Authority

- Ghana Health Service VR

Volta Sports Associations

Our Mobile Application App is coming soon! Stay tuned.

© Copyright 2022 voltaweb. All rights reserved.

Leave a comment